- Financial Maverick

- Posts

- Savings Psychology, Housing Crisis, and Boosting Affiliate Sales

Savings Psychology, Housing Crisis, and Boosting Affiliate Sales

Traveling for spring break? Here are some tips to save money

Good morning. It's Tuesday, March. 12 and we're covering strategies to protect your goals from consistent inflation, how to boost your affiliate marketing sales, 48 of the most clever tips real estate agents have shared, and much more.

First time reading? Sign up here.

Stock Market Update

Market Performance: March 8, 2024.

US stocks closed mixed on Monday while bitcoin (BTC-USD) extended its record rally as investors counted down to crucial inflation data that will test bets on interest rate cuts.

The Dow Jones Industrial Average (^DJI) rose 0.1%, while the S&P 500 (^GSPC) shed 0.1%. The Nasdaq Composite (^IXIC) fell about 0.4%, extending Friday's sharp decline in the tech heavy index.

Now the market is bracing for a last big test before the Federal Reserve's March 20 policy meeting. The Consumer Price Index report on Tuesday is front of mind after Chair Jerome Powell said the Fed wants to be more confident that inflation is cooling before easing up on borrowing costs. Given that, a surprise rise would undermine the optimism for a Fed policy shift that has boosted stocks.

Financial Maverick Insights

Strategies to Protect Your Goals from Consistent Inflation

If you’re like most investors, you’ve noticed the impact of higher inflation in recent years – whether at the gas pump or the grocery store. American investors are experiencing the effects of prolonged inflation for the first time since the early 1980s.

As a result, many are concerned about how inflation levels will impact their ability to reach their long-term financial goals. While it may not be possible to avoid the effects of inflation altogether, there are several strategies investors can utilize to mitigate the impact of inflation on their financial plan.

Here are three investment considerations that may help address inflation concerns and better prepare your goals for long-term success.

1 – Keep your money invested

When the inflation rate soared in 2022, stock and bond markets declined. Some investors responded by pulling money out of the market. This can be counterproductive as investors too often miss much of a market’s recovery gain before they put their money back to work.

2 – If time is on your side, take advantage of stocks

Over time, stocks have historically outpaced inflation, an important consideration as you try to build wealth to achieve your ultimate financial goals with more confidence. This doesn’t mean that year-in, year-out, stocks will keep you ahead of inflation.

3 – For short-term money, seek higher yields

You may have money set aside for short-term needs, such as your emergency fund or to cover upcoming expenses. In these times of elevated inflation, you’ll want to find ways to earn more competitive yields on your short-term savings. Search out options such as money market funds, CDs, short-term U.S. Treasury securities and other savings vehicles that offer yields that may keep pace with inflation.

Struggling to Boost Your Affiliate Marketing Sales? Easy Money School Launches "Affiliate Boost" Resource

Are you an affiliate marketer frustrated with stagnant sales? Do you spend hours crafting promotions that fall flat?

Easy Money School, a leading resource for online entrepreneurs, today announced the launch of "Affiliate Boost," a comprehensive program designed to help affiliates skyrocket their earnings. "

The affiliate marketing landscape is constantly evolving," says William Caleb, founder of Easy Money School.

"Many affiliates -especially those who promotes products in the affiliate marketing niche itself- struggle to keep pace with the latest strategies and tactics. Affiliate Boost bridges that gap, equipping affiliates with the tools and knowledge they need to consistently generate sales and maximize their commissions."

Communicate clearly and upfront

With Affiliate Boost, affiliates can expect to:

Increase brand awareness and product visibility.

Drive targeted traffic to their affiliate links.

Convert more leads into paying customers.

Maximize their earning potential through strategic marketing techniques.

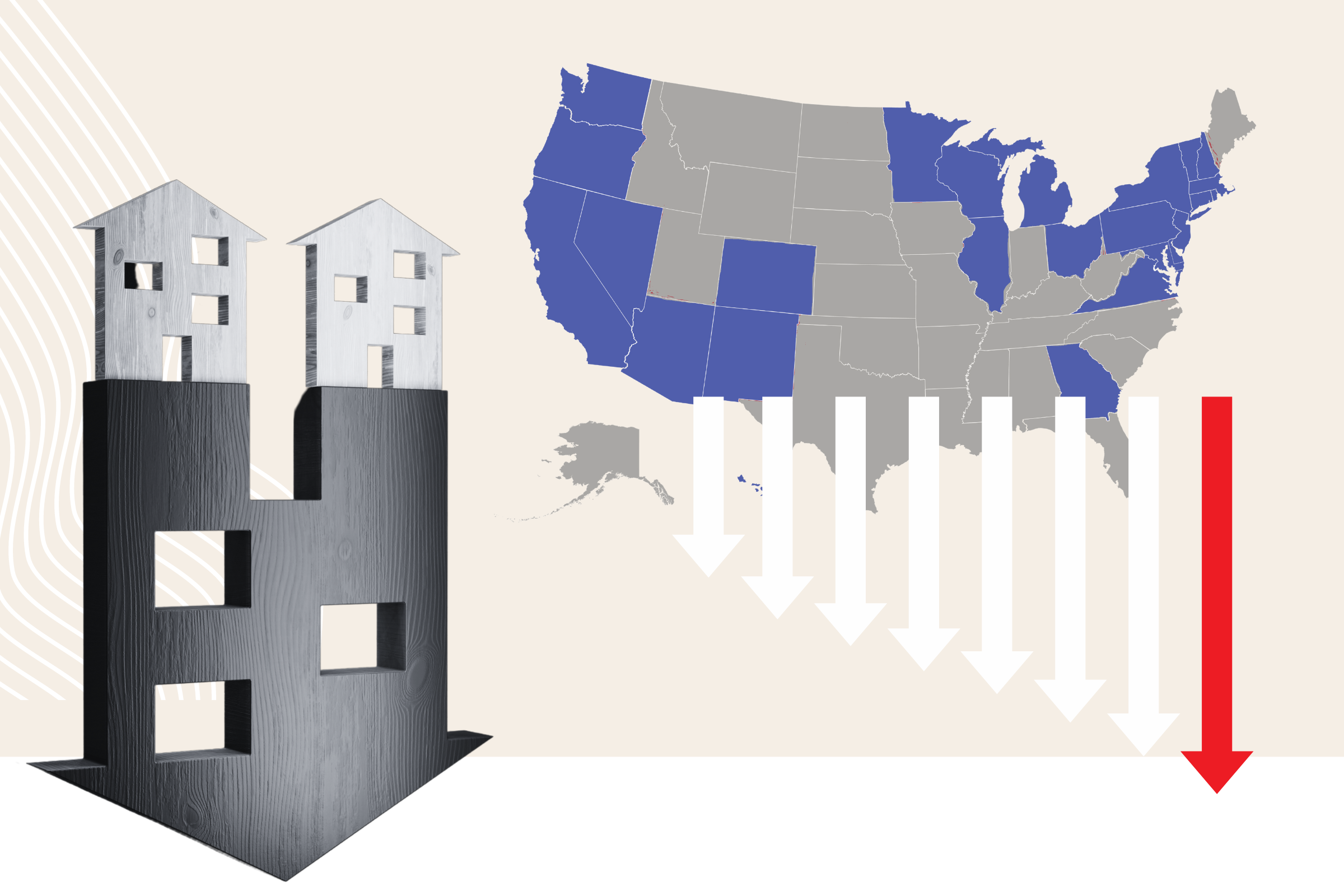

Real Estate News

Personal Finance Tips

Alternative Investing

Do you believe AI will run out of electricity and transformers in 2025? |

Reach Over 100,000 Financial Mavericks

Advertise with Financial Maverick to get your brand in front of the Financial Gurus in the world. The Mavericks are high-income and highly knowledge people who are always looking for an interesting product or tool.

Calling all Financial Mavericks! To help out a family and friend in need by sharing this newsletter. Tell you what if you ever wanted to be a Hero, Financial Guru, or a Nice Person this is your time!

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.